Determine your tax residency status, pay taxes, get bank accounts re-designated

With President Donald Trump ordering a review of the H1B visa program in the US, there are widespread fears among Indians working in the IT sector that they may have to return home. For those who have migrated to the Middle East, too, obtaining citizenship is difficult, necessitating a return at the end of their work tenure. Whatever the reasons for returning, non-resident Indians (NRIs) need to plan the shift meticulously. Besides finding a job that does justice to their skills and getting their children admitted into the right schools and colleges, they also need to handle the financial aspects of the transition well.

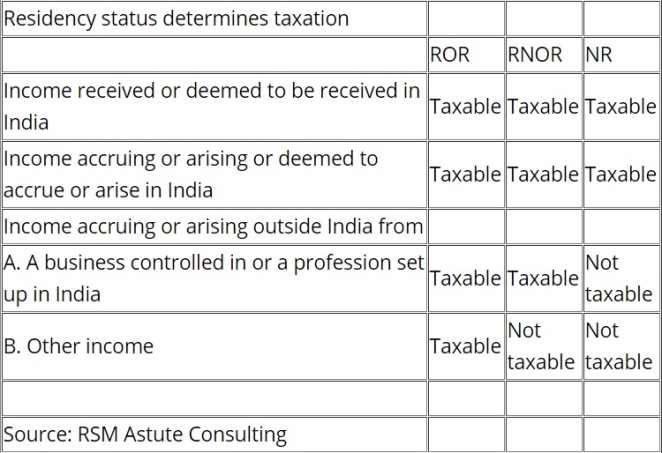

Tax residency status: Upon his return, an NRI first needs to determine his residency status for the purpose of income tax. This depends on the number of days he has been present in India. “India follows a physical presence test as the sole criterion for determining an individual’s residential status for income tax purpose,” says Suresh Surana, founder, RSM Astute Consulting. An individual can fall in any of these three categories: resident and ordinarily resident (ROR), resident but not ordinarily resident (RNOR, an intermediate stage for returning NRIs), and non-resident (NR). His residency status will determine how he is taxed

During the first financial year after his return, assuming that he spends more than 182 days in India, his residential status will be that of a resident. However, if out of the preceding 10 years, he has been a non-resident for at least nine years, his status will be RNOR, irrespective of the period of stay in India during the first year. In the second year also, similar rules will apply and he may remain a RNOR. “If he qualifies for RNOR status in the first two years, he can stay throughout the year in India without any adverse tax implication on income accruing or arising outside India, except income accruing outside India from a business controlled in India,” says Surana. In the third year, assuming that he has been resident during both the first two years, he can claim RNOR status only if his stay in India is for 729 days or less in the seven years immediately preceding the third year. Otherwise, he will become an ROR and his global income will be taxed in India. In subsequent years, the benefit of RNOR status will no longer be available and he will become an ROR. (READMORE…)